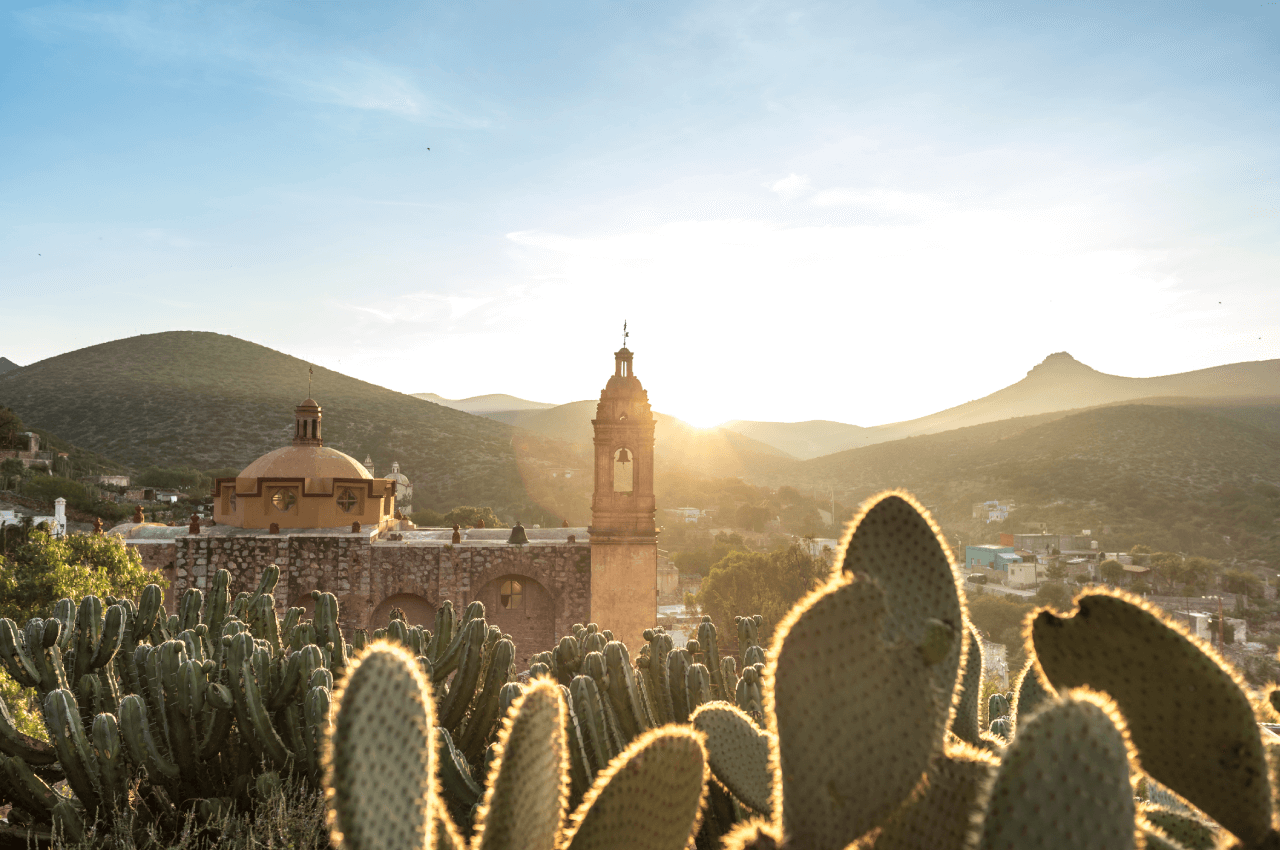

Explore Our Coverage

For Canadian Residents

Emergency Medical Care

Travel is full of surprises, and falling ill or getting injured is never part of the plan. In case of a medical emergency, this coverage takes care of the costs for necessary treatments and services, providing up to $5,000,000 per trip.

In case of a medical emergency due to illness or accident during your trip, your travel insurance can help cover expenses such as:

-

Hospitalization costs (semi-private or private room)

-

Emergency dental care

-

Medical and paramedical treatments

-

Medical follow-up in Canada following repatriation

-

Transportation costs (ambulance or taxi service, repatriation to your province of residence if required by your health condition, transport costs to visit the insured person, costs for the return of the vehicle, costs for the return or burial or cremation of the remains in the event of death)

-

Subsistence allowance (accommodation, meals, essential phone calls, taxis, childcare expenses for accompanying children)

For complete coverage details, please refer to your travel insurance policy.

Please note that medical expenses resulting from certain situations are not covered. For example:

-

Trips undertaken for medical purposes

-

High-risk sports or activities

-

Suicide and intentional injury

-

Consumption of alcohol, drugs and other intoxicating substances

-

Illegal acts

-

Acts of war and civil unrest

The policy has other exclusions, including some due to pre-existing medical conditions. Do you have a pre-existing condition? The Option: Reduced Stability Period may interest you! Call us at 1-855-906-8990, Monday-Friday, 8 a.m.-6 p.m. to learn more and get a quote.

For full details, please refer to your travel insurance policy.

Explore our comprehensive travel insurance options.

For our most comprehensive insurance in case of an emergency or unforeseen event, you can combine all coverage options:

Emergency Medical Care, Trip Cancellation and Interruption, Accidental Death or Dismemberment, and Baggage.

Explore our comprehensive travel insurance options.

For our most comprehensive insurance in case of an emergency or unforeseen event, you can combine all coverage options:

Emergency Medical Care, Trip Cancellation and Interruption, Accidental Death or Dismemberment, and Baggage.

Frequently Asked Questions

The coverage provided by your credit card company may have limitations or restrictions. It is important to review your policy thoroughly for coverage details. It is often recommended that you purchase additional coverage for complete protection.

Check your credit card coverage for the following:

Travel duration

Travel insurance cannot be purchased once you depart from Quebec. It is important to check the length of stay covered by your credit card company, as well as any restrictions based on age.

Emergency medical care coverage

There are often strict eligibility and stability requirements based on your current health. Make sure you understand the exclusions in your coverage prior to your departure. You could be quite unhappy to learn that a health condition is excluded right when you need emergency medical care. Also make sure the coverage amounts are enough, and inquire about any deductibles you may have to pay.

Trip cancellation and interruption

If you incurred fees up front, make sure the amount covered under trip interruption/cancellation is enough to save you from financial losses. Most credit card companies do not cover trip interruption or cancellation, and when they do, the maximums are not sufficient to fully cover your costs. Blue Cross can provide you with coverage that protects you in the case of unforeseen situations.

Protect yourself and your family. Don’t risk your financial security with incomplete coverage. With Blue Cross travel insurance, you enjoy complete medical coverage by a travel insurance company recognized around the world.

Blue Cross travel insurance offers several deductible amounts if you wish to reduce your insurance premium, but they are not mandatory. If you do choose a deductible, you are responsible for any costs up to the chosen deductible amount.

An illness or medical condition that already exists at the time of departure is considered pre-existing. To be covered by travel insurance, your pre-existing condition must remain stable for a specified period, as outlined in the contract. The stability period varies depending on your age. You may reduce this stability period by choosing the Option: Reduced Stability Period. Please feel free to contact one of our agents for further information regarding travel insurance coverage related to your health condition.

That’s only partially true. Medical costs are covered across Canada, but provincial health plans:

- Do not offer the same services to non-resident travellers as they do to residents (even though you are Canadian, you are considered a non-resident even if you live in a neighbouring province).

- Vary from one province to another and do not pay the same rates in all provinces.

Below are some examples of costs you may need to pay in a neighbouring province:

- Return of vehicle

- Air ambulance

- Relatives visiting when you are hospitalized

There are billing agreements between certain provinces, but not all. Since medical costs vary from one province to another, what may be sufficient to cover a medical service in one province may not be enough to cover the same service in another.

Yes, unless you’re unable to do so. Our 24/7 assistance team is here to guide you to the best possible care. In case of a medical emergency, you must contact Blue Cross Travel Assistance immediately. Failure to do so before receiving treatment may result in your claim being denied. If you’re unable to contact us beforehand, seek care at the nearest clinic or hospital and call us as soon as possible to open your assistance file.

Read Our Blog Posts

Keeping you covered while enjoying your favourite activities!

Do you feel inspired to try new activities and stay active when you travel? Why not start planning...